Inflation peaked at over 9% in mid-2022 but decreased to 7.1% last year. Recent reports suggest that inflation measured by the CPI has gradually decreased and is now around 3.2%. However, core inflation, which excludes volatile food and energy prices, remains high at 4.1%. While inflation has decreased, the degree of decline varies depending on the measurement used, resulting in continued fear, uncertainty, and doubt (FUD) among most Middle American consumers.

Energy prices, particularly oil and gas, have significantly decreased in the past year, impacting our cost of living. While gas prices initially rose by over 60%, they have since decreased along with the price of oil. However, diesel prices remain higher than a couple of years ago.

Continue reading for the two actions you should take now in 2023 to beat inflation in 2024.

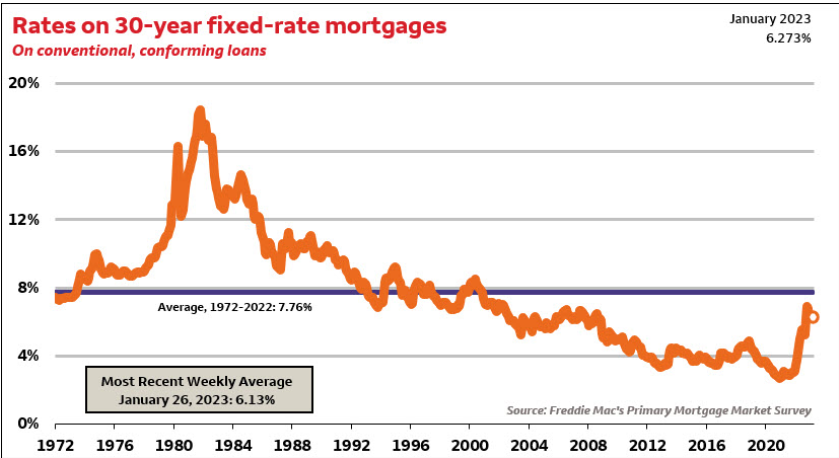

The Federal Reserve has significantly increased interest rates, with the Federal Funds rate rising from 0.8% in November 2021 to 5.33% in October 2023. This has impacted Main Street Americans, who now see higher rates in their investments. You can find the most current rates for November 2023 from Investopedia.com.

Higher interest rates slow down the economy by reducing borrowing and curbing inflation. This has decreased some prices but increased home prices and mortgage rates significantly. As a result, many potential homeowners can no longer afford the highest mortgage rates in over twenty years (currently at nearly 7.77% from less than 2.67% in 2020).

Housing makes up a significant portion of CPI, and when its growth slows down, it brings inflation down. Overall, the increase in interest rates has had a profound impact on the economy and the financial markets and will continue to do so in the coming years.

Lastly, the pandemic caused significant disruptions in the development and distribution of national and international supply chains, resulting in several disruptions that no longer exist.

What is The Phillips Curve & What Does it Tell Us?

The Phillips Curve, as per the Corporate Financial Institute, indicates that unemployment is high when inflation is low, and unemployment is low when inflation is low.

Inflation has decreased while employment rates remain high, resulting in low unemployment rates. Experts have different opinions on this phenomenon. Jeremy Siegel believes that the economy is growing, and productivity is improving. Jon Sindreu thinks that labor is not a reliable indicator of inflation, while Rick Roeder believes that higher rates do not hurt the economy. Despite some negative impacts on parts of the economy, the cost of living is decreasing, employment remains resilient, and the economy is growing.

So is this a trend or a short-term phenomenon?

Is this a short-term phenomenon or a long-term trend? I’ve concluded there are a few reasons behind our current inflationary perplexity:

- Technological advancements, such as AI are driving the economy’s growth.

- Many Main Street Americans have higher-than-normal liquidity due to leftover pandemic stimulus funds in their checking and savings accounts.

- It appears that the current labor shortage is responsible for keeping unemployment rates low. Depending on the sources of information and level of trust, the labor shortage might persist for a while. The emergence of the Gig Economy has led to a situation where almost half of the working population is not represented in the traditional labor statistics because they are now categorized as independent contractors rather than employees.

Based on my analysis, I have observed a consistent rise in consumer consumption, another major contributing factor. According to the US Census Bureau, the population growth rate of the United States was reported to be 0.4% for the twelve months ending in July 2022. This indicates that approximately 1.3 million people were added to the US population during that period, meaning that more than 100,000 individuals are added to the US population every month. This growth has a significant impact on driving consumption.

According to the Federal Reserve Bank of St. Louis, almost 10,000 people are turning 65 daily for the next two decades. This means that almost 300,000 people are retiring every month in the United States. If more Main Street Americans have decided to stay at home, we might face a long-term labor shortage or a significant shift in how Corporate America hires. Therefore, the labor shortage may not be accurate, but it could just be different.

Prior to the pandemic, many articles predicted a labor shortage starting in 2010 that would last well into the third decade of the 21st century. Since the pandemic, we have witnessed the retirement of baby boomers happening at a faster rate than anticipated. Many companies are encouraging early retirement, leading to potential shortages in various economic sectors. Despite predictions of significant wage inflation, the shortage has not yet had such an effect. This leads to the question of whether it is truly a shortage or a new norm.

How Should You Prepare For The Unknown Economic Future of Your Family?

What about the Main Street entrepreneurs, small business owners, and Middle American consumers? With short-term savings and money market yields currently above 5%, the first action you should take is to establish an emergency fund covering six months of your monthly expenses. Your second action is to fund a Medical Savings Account. Your third action, consider seeking credit cards with 12 to 18 months of interest-free or extremely low introductory rates and transfer unpaid balances to these new cards. Concentrate on paying off these balances from lowest to highest within the period of your new, lower interest rate.

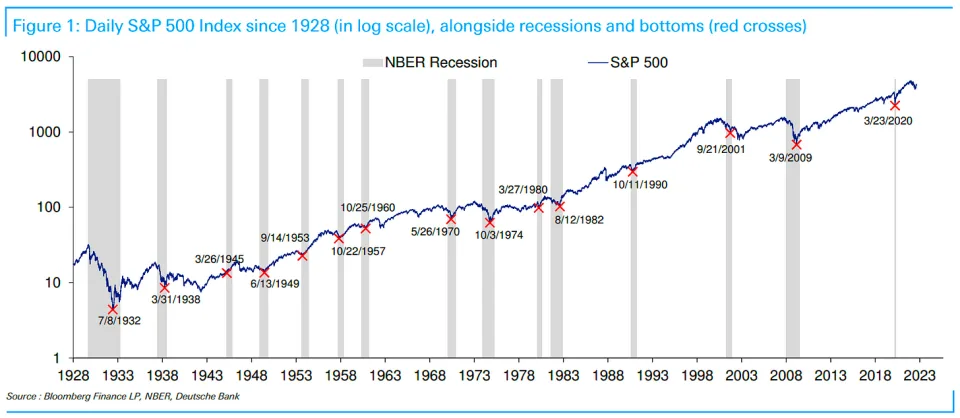

As per my analysis, I have studied stocks across the board. For long-term buy-and-hold investors, stocks can open up opportunities, but it is not recommended for day traders. If you want to avoid stock price fluctuations, go for Fortune 100-500 companies that offer a nice quarterly or annual dividend. However, if you are willing to take a higher risk and have over 20 years before retiring, you can consider investing in mid-cap or even small-cap stocks.

It’s worth noting that fixed-income rates on bonds have recently gone up. Historically, bonds have been an excellent investment for hedging against inflation, and they may also be a good option for you. The increase in longer-term rates is partially due to the US Treasury issuing more bonds with extended maturity periods, driving up yields and lowering prices. Investors can secure good long-term yields in three main bond types: treasuries, corporate, and municipal bonds. However, you should review the duration before investing in a specific bond.

Still unsure what’s best for you; don’t want to jeopardize your family’s future? FUD is real and can cause us to procrastinate, even when what our broker tells us makes sense. So, move back to another secured and insured type of investment: the tried and true CD. You may have to look around, but many online-only banks are currently offering 6% yields on 12-month CDs.

Interest rates can change quickly, so it’s important to act fast. CDs used to have high-interest rates, but now they’re not as profitable. Investing in private and public company stocks can be more profitable. Consider securing short-term yields before the end of the year because the Central Bank may lower rates for political reasons. This could happen in 2024.

As I have mentioned before and will reiterate, no one-size-fits-all strategy works for everyone at all times in their life. However, maintaining a balanced investment portfolio is an excellent rule of thumb. This means having a mix of stocks and long-term and short-term investments. It is also vital to ensure that you have at least six months’ worth of liquid funds and be prepared for any economic fluctuations as best as possible. While diversification and asset allocation do not guarantee profits or protect against losses, they can help manage risks.

Use this article for educational purposes only, not as investment advice. Consult your broker for personalized investment guidance based on your long-term goals.

Living An Epic Adventure,

Troy Dooly

P.S. Here are some additional resources for you to explore:

What You Should Know About The US Economy in 4th Quater 2023

Leave a Reply